How to Calculate Profit Margins for Your E-Commerce Store

Figuring out your profit margin is pretty simple on the surface. You just subtract all your costs from your total revenue, divide that by the revenue, and multiply by 100 to get your percentage.

The goal is to scale without dubious shortcuts and without hurting your credibility.

But mastering this calculation is way more than just doing the math. It’s the key to understanding the real financial health of your e-commerce store and making smarter decisions that actually move the needle.

Why Profit Margin Is Your Most Important E-Commerce Metric

It’s so easy to get caught up in the chase for revenue, especially when you're starting out. Big, flashy sales numbers look great, but they don't tell you the full story. The metric that truly matters is profitability—how much money you actually get to keep after every single expense is paid.

Focusing on your profit margin is probably the most critical skill you can develop for sustainable growth.

This isn't about getting lost in a spreadsheet. It’s about getting an honest, unfiltered look at how your business is really doing. When you understand your margins, you can price your products with confidence, get a handle on those sneaky hidden costs, and make strategic moves that lead to long-term success, not just a temporary sales bump.

The Three Essential Margins

To get the full picture, you need to look at three different types of profit margins. Each one gives you a unique window into your store's performance, from how viable your products are to how efficiently you're running the whole operation.

Before we dive into the "how-to," let's quickly break down what these three margins are and why each one is so important for store owners.

The Three Key Profit Margins at a Glance

| Margin Type | What It Measures | Why It Matters for Your Store |

|---|---|---|

| Gross Profit Margin | The profitability of your products alone, before operating costs. | Tells you if your core business model is sound. If this number is low, your pricing or cost of goods is off. |

| Operating Profit Margin | The efficiency and profitability of your core business operations. | Shows how much money you're making from just running the business, after things like marketing and software fees. |

| Net Profit Margin | Your "bottom-line" profitability after all expenses are paid. | This is the truest measure of profitability—the percentage of revenue you actually bank as profit. |

Each margin tells a piece of the story, and you really need all three to make informed decisions.

By analyzing all three, you can pinpoint exactly where your business is crushing it and where money might be leaking out. For instance, a fantastic gross margin but a weak net margin is a huge red flag that your operating costs are eating up all your profits.

Getting comfortable with calculating these margins is fundamental. It doesn't matter if you're selling on Shopify, grinding it out with Amazon FBA, or blowing up on TikTok Shop—these numbers will guide your strategy and make sure you’re building a business that’s not just growing, but genuinely profitable.

Calculating Gross Profit Margin to Validate Your Pricing

Your gross profit margin is the first—and most important—health check for every single product you sell. It cuts through the noise of marketing spend, software fees, and salaries to answer one critical question: is this product actually making money on its own?

Think of it as the bedrock of your store's financial stability. Before you worry about anything else, you have to get this right.

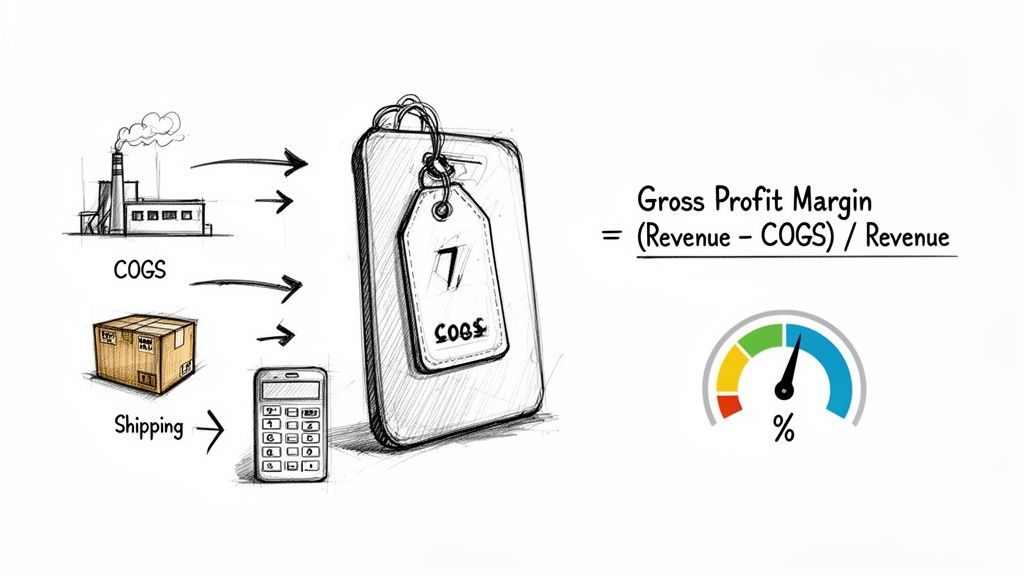

The formula itself looks simple enough, but the real work is in pinning down an accurate Cost of Goods Sold (COGS). That’s where many store owners slip up.

Gross Profit Margin = [(Revenue - COGS) / Revenue] x 100

This calculation shows you what percentage of revenue is left after paying for the product itself. A healthy gross margin means you have plenty of cash left over to cover your other business expenses and, hopefully, leave you with a nice profit at the end of the day.

Nailing Down Your Cost of Goods Sold

For an e-commerce brand, your Cost of Goods Sold (COGS) is so much more than what you paid your supplier. It’s the total sum of every direct cost needed to get that product into a sellable state. If you miss even one small component here, you'll get a misleading and dangerously optimistic view of your product's profitability.

A solid COGS calculation must include:

- Product Cost: The actual per-unit price from your manufacturer.

- Inbound Shipping: What it costs to get the inventory from your supplier to your warehouse or 3PL.

- Import Duties & Tariffs: Any taxes and fees you paid to get the goods across the border.

- Packaging Materials: The cost of the boxes, mailers, tape, and void fill used for each order.

Let's run through a practical example. Say you run a Shopify store selling a trending skincare product.

You source each unit for $8.00. After factoring in a bulk freight shipment and customs fees, the inbound shipping and duties work out to $1.50 per unit. You sell the product for $30.00.

Here's the breakdown:

- Revenue: $30.00

- COGS: $8.00 (product cost) + $1.50 (shipping/duties) = $9.50

- Gross Profit: $30.00 - $9.50 = $20.50

- Gross Profit Margin: ($20.50 / $30.00) x 100 = 68.3%

That 68.3% gross margin is fantastic. It gives you a strong foundation and a lot of room to pay for your TikTok ads, Shopify plan, and all the other costs of running the business.

What Is a Good Gross Margin?

So, how do you know if your margin is any good? It helps to look at industry benchmarks for context.

For the Retail (Distributors) sector, where most e-commerce brands fit, the average gross margin is a decent 30.57%. But here’s the kicker: the average net profit margin in the same sector plummets to just 6.05%.

That stark difference shows how quickly operating costs—shipping, ads, returns, software—eat away at your initial profit. It means that for every $100 in sales, the average store might only keep $6 as pure profit. You can dig into more detailed data for different industries on the NYU Stern website.

To make sure your numbers are always on point, a dedicated retail profit margin calculator can be a huge help. Getting your gross margin right isn’t just good practice; it’s the only way to validate your pricing and ensure you’re actually building a sustainable business.

Measuring Your Store's Efficiency with Operating Profit Margin

So, you’ve calculated your gross margin and confirmed your products are actually making money. That's a huge first step. But a high gross margin is only half the story. It doesn't mean much if the costs of simply running the business are eating up all that profit.

This is where your operating profit margin comes in. Think of it as the true health check for your store's efficiency.

It tells you how much profit your business makes from its core operations—everything before you account for things like interest and taxes. It’s a fantastic way to see how well you're managing the day-to-day expenses of your e-commerce brand.

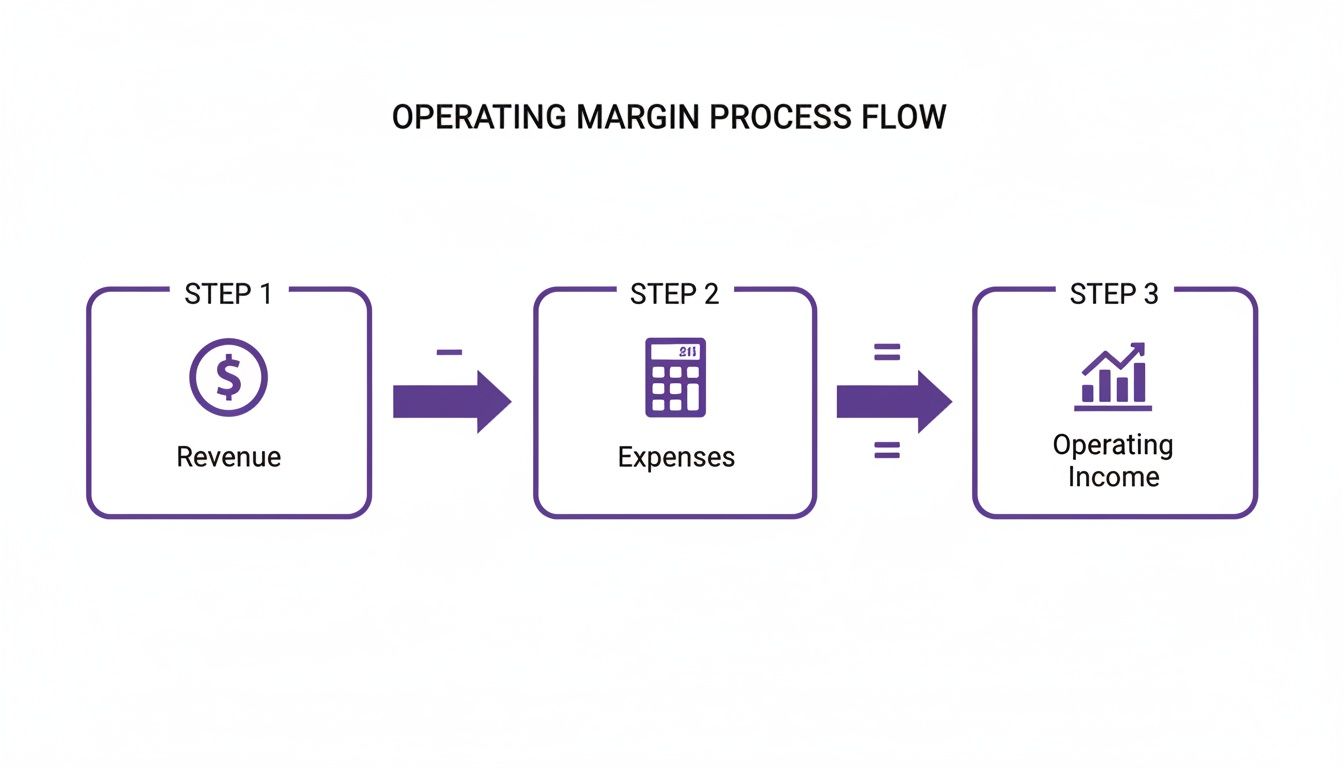

The formula itself is pretty simple:

Operating Profit Margin = (Operating Income / Revenue) x 100

To get your Operating Income, you just take your gross profit and subtract all of your operating expenses. This is the moment of truth that separates a genuinely healthy business from one that’s just busy, not profitable.

What Are Operating Expenses?

Operating expenses, or OPEX as you'll often hear, are all the costs of keeping the lights on that aren't directly part of the product itself (that was COGS). For any modern DTC store, this list gets long, fast.

Here’s a look at what typically falls into this bucket:

- Marketing & Advertising: This is your ad spend on platforms like TikTok, Meta, or Google. It's often the biggest line item.

- Platform Fees: Your monthly Shopify subscription, Amazon FBA fees, and those pesky payment processing fees.

- Software & Subscriptions: All the tools that make your store tick. Think email marketing platforms, design software, and research tools like Helium10 or Semrush.

- Salaries & Wages: What you pay your virtual assistants, customer service reps, or even yourself.

- Shipping & Fulfillment: The fees you pay your 3PL or warehouse staff, plus the costs of boxes, tape, and labels for getting orders out the door.

These costs sneak up on you. I've seen stores with fantastic gross margins on paper get completely wiped out because they're paying for a dozen different software subscriptions they barely use. Operating profit margin shines a bright light on this.

Putting It All Together: A DTC Brand Example

Let's walk through a real-world scenario. Imagine a DTC brand selling custom phone cases. Last month, they pulled in $50,000 in revenue, and after accounting for COGS, they were left with a gross profit of $30,000. Not bad.

Now, let's add up their operating expenses for the month:

- TikTok Ad Spend: $8,000

- Shopify Plan: $100

- Klaviyo Subscription: $150

- Canva Subscription: $15

- VA Salary: $1,000

- 3PL Fulfillment Fees: $4,000

- Total OPEX: $13,265

With these numbers, we can figure out their operating income:

- Operating Income: $30,000 (Gross Profit) - $13,265 (OPEX) = $16,735

And finally, we can plug that into our formula to get the operating profit margin:

- Operating Profit Margin: ($16,735 / $50,000) x 100 = 33.47%

A margin of 33.47% is a very healthy sign. It shows that after paying for the products and all the costs associated with marketing and selling them, the business is still generating a strong profit. If that number were low—say, in the single digits—it would be an immediate red flag to start auditing everything from ad spend to software subscriptions to find where the money is leaking.

Finding Your True Bottom Line with Net Profit Margin

We’ve looked at the money you make on your products and the health of your day-to-day operations. Now, we’ve arrived at the final, most crucial checkpoint: your net profit margin.

This is the number that cuts through all the noise. It’s your true bottom line, showing exactly how much cash your business actually keeps after every single expense has been paid. It answers the one question that really matters to any founder: are we actually making money?

Net Profit Margin = [(Revenue - Total Expenses) / Revenue] x 100

The formula itself looks simple enough. But the real work is in nailing down that “Total Expenses” figure. This single term covers absolutely every cost your business has, from the cost of your products to the interest on a business loan.

Breaking Down Total Expenses

Getting an accurate net profit margin means you have to be meticulous. Think of it as adding up everything we've already covered, plus a couple of final, often forgotten, line items.

Your total expenses will always include:

- Cost of Goods Sold (COGS): The direct costs of producing and acquiring your inventory.

- Operating Expenses (OPEX): This is your marketing spend, software subscriptions, salaries, and platform fees.

- Interest: Any payments you make on business loans or lines of credit.

- Taxes: The corporate or income taxes you owe on your profits.

Only when you subtract this complete total from your revenue do you arrive at your true net income.

This visual really clarifies how revenue and operating expenses create your operating income. That number is a critical stepping stone, representing your profit before you account for those final two pieces: interest and taxes.

An Amazon FBA Seller Example

Let's bring this to life with a real-world scenario. Say we have an Amazon FBA seller who pulled in $80,000 in revenue last quarter.

Here’s what their total expenses might look like:

- COGS: $25,000

- Operating Expenses:

- Amazon FBA Fees: $12,000

- PPC Ad Spend: $10,000

- Storage Fees: $1,500

- Software (like Helium 10): $500

- Interest on Loan: $1,000

- Estimated Taxes: $6,000

First, we need to add up all those costs:

$25,000 + $12,000 + $10,000 + $1,500 + $500 + $1,000 + $6,000 = $56,000

Next, let's figure out their net profit (the actual money they made):

$80,000 (Revenue) - $56,000 (Total Expenses) = $24,000

And finally, we can calculate the net profit margin:

($24,000 / $80,000) x 100 = 30%

A 30% net profit margin is fantastic. It’s a clear sign of an exceptionally healthy business. This calculation connects all the dots, showing how every decision—from ad budgets to supplier contracts—directly impacts the money you actually get to keep.

For context, the Internet, E-commerce, and Online Shops industry has an average EBITDA margin of 9.93%, though strong quarters have seen it hit 23.21%. For ambitious Shopify owners and Amazon sellers, numbers like these show why mastering how to calculate profit margins isn't just a good idea—it's essential for survival and growth. You can explore more e-commerce profitability ratios on CSIMarket.com.

Ready to Improve Your Profit Margins? Here’s How.

Okay, so you've done the hard work of calculating your profit margins. That's the diagnostic phase. Now for the treatment. Knowing your numbers is one thing, but actually improving them is how you build an e-commerce business that can weather any storm.

The good news is you have several powerful levers you can pull to directly boost your bottom line, from gross margin all the way down to net. Let's move past the theory and dive into some practical, e-commerce-focused tactics you can start using today.

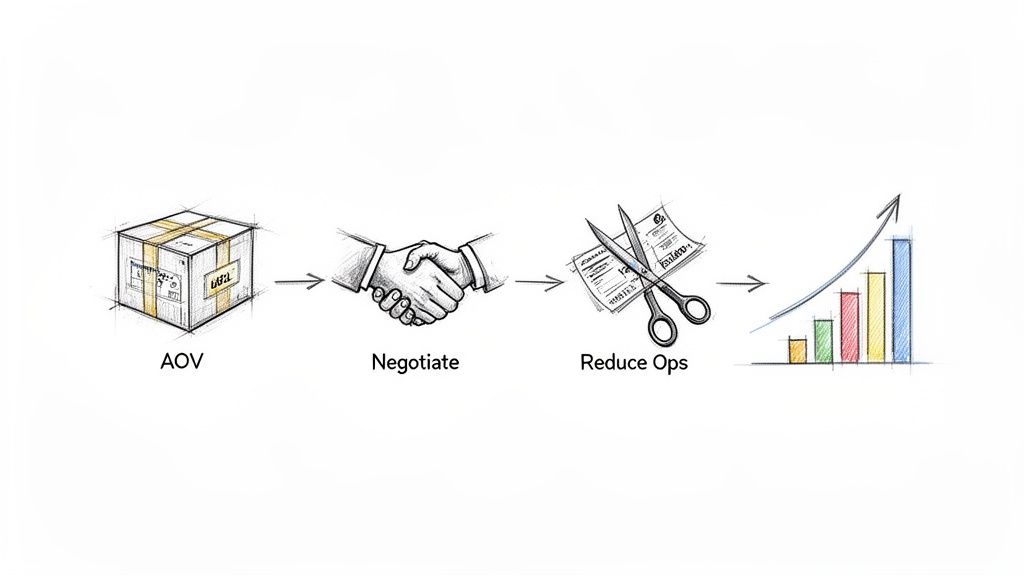

Increase Your Average Order Value

One of the fastest ways to improve margins without hunting for new customers is simply to get each one to spend more per transaction. This is all about bumping up your Average Order Value (AOV). When a customer's cart total is higher, the fixed costs of that sale (like payment processing fees) get spread thinner, making the whole order more profitable.

Here are a few smart ways to boost your AOV:

- Product Bundling: Group complementary products together at a slightly discounted price. If you're selling coffee on Shopify, you could bundle beans, filters, and a mug for a price that feels like a better deal than buying each item on its own.

- Tiered Free Shipping: Instead of offering free shipping on everything, set a threshold. A simple banner saying, "Free shipping on orders over $75!" is often all it takes to encourage someone to add one more item to their cart.

- Post-Purchase Upsells: Use an app that presents a one-click upsell after a customer has already paid. This is brilliant because it doesn't add any friction to the main checkout flow but still gives you a shot at capturing extra, high-margin revenue.

Drive Down Your Cost of Goods Sold

Your Cost of Goods Sold (COGS) is the arch-nemesis of your gross profit margin. Every single dollar you can shave off here goes straight to your bottom line, freeing up cash to pour back into growth.

Start by taking a hard look at your supplier relationships. Is there room to negotiate better terms? Committing to a larger order volume can often unlock a lower per-unit cost. For instance, you might be able to negotiate a 5% discount just by increasing your quarterly order from 1,000 units to 2,500. That one conversation can immediately widen your gross margin on every single thing you sell.

Don't be afraid to explore alternative suppliers or manufacturing locations, either. The sourcing landscape is always in flux; the best deal you found six months ago might not be the best deal today. Get fresh quotes.

Slash and Consolidate Operating Expenses

Operating expenses (OPEX) are the silent killers of profit. This is where you'll find costs like software subscriptions, marketing agency retainers, and platform fees. As a business scales, these costs often grow on autopilot without anyone noticing.

A classic pitfall for growing e-commerce stores is "subscription creep." Suddenly, you're paying for a dozen different tools that all do roughly the same thing. A monthly audit of your software stack is non-negotiable.

Consolidating your tools is a huge win. Instead of paying for separate tools for SEO, ad spying, and content creation, an all-in-one platform can dramatically reduce your monthly OPEX. Some services bundle dozens of premium tools for a single, low fee, potentially slashing software costs by over 90%. That's a direct boost to your operating and net profit margins.

As a business gets more complex, working with fractional CFO services can also provide the strategic financial oversight needed to dig into these spending habits and find savings.

Optimize Your Customer Acquisition Cost

Finally, let's talk about your Customer Acquisition Cost (CAC). For most direct-to-consumer brands, this is a massive operating expense. If you can lower the cost to get each new customer in the door, your marketing dollars become far more efficient, directly padding your operating margin.

- Improve Ad Creative: Never stop testing. On platforms like TikTok and Meta, constantly experiment with new ad formats, copy, and visuals. Find what clicks with your audience to lower your cost-per-click and cost-per-acquisition.

- Focus on Retention: I'll say it again: it's almost always cheaper to keep a customer than to find a new one. Invest in your email marketing and loyalty programs to drive repeat purchases, which come with a near-zero acquisition cost.

- Refine Your Targeting: Get surgical with your audience profiles. Dig into your customer data and figure out exactly who your best customers are. Wasting ad spend on people who will never buy is one of the fastest ways to destroy your margins.

To make this even clearer, here's a quick-reference table of the different levers you can pull to improve your store's profitability.

Margin Improvement Levers for Your E-Commerce Store

| Strategy Lever | Primary Margin Impact | Example Action |

|---|---|---|

| Increase Average Order Value | Gross & Operating | Offer a "free shipping over $75" threshold to encourage larger cart sizes. |

| Negotiate Lower COGS | Gross | Commit to a larger inventory order with your supplier in exchange for a 5% per-unit discount. |

| Consolidate OPEX | Operating & Net | Cancel redundant software subscriptions and switch to an all-in-one platform. |

| Optimize Ad Spend | Operating & Net | A/B test ad creative on TikTok to find a version that lowers your Customer Acquisition Cost. |

| Boost Customer Retention | Operating & Net | Launch a simple loyalty program that rewards repeat purchases with points or discounts. |

Each of these strategies targets a different part of your profit and loss statement, but they all work toward the same goal: building a more resilient and profitable business. Pick one or two that feel most achievable and start there.

A Few Lingering Questions on Profit Margins

Knowing the formulas is one thing, but applying them to your own business is where the real questions pop up. I get these all the time from store owners, so let’s clear up the most common points of confusion.

Nailing these details is what separates a fuzzy guess from a truly accurate picture of your store's financial health.

How Often Should I Be Running These Numbers?

Think of it in two cadences: a monthly deep dive and a weekly pulse check.

You absolutely need to calculate all three margins—gross, operating, and net—every single month. It's non-negotiable. This monthly review gives you that big-picture view of your business's health and lets you spot trends before they become major problems.

But don't wait 30 days to see if a product is bleeding cash. I always tell my clients to do a quick-and-dirty gross margin check on their top-selling products every single week. This is your early warning system. It'll immediately flag if a supplier just hiked prices or if your ad performance is slipping, giving you time to react before the damage is done.

What’s a “Good” Profit Margin in E-Commerce, Anyway?

This is the million-dollar question, and the honest answer is: it depends. What's fantastic for a dropshipper is terrible for a high-end fashion brand.

That said, a solid benchmark for most e-commerce stores is a net profit margin somewhere between 10% and 20%. If you're in that zone, you likely have a healthy, sustainable business with enough cash to pour back into growth.

But remember, context is king:

- Selling high-volume, low-cost items? You'll naturally operate on tighter margins.

- Dealing in luxury or custom-made goods? You should be aiming for much, much higher margins to justify the model.

- In an all-out growth sprint? Your margins might dip temporarily because you're spending a fortune on marketing.

The goal isn't to hit some arbitrary number. It’s about deeply understanding your own numbers and making them better over time. A 5% margin that’s trending up is a much healthier sign than a 15% margin that’s shrinking month after month.

Where Do Most People Screw Up the Math?

When store owners are first learning how to calculate profit margins, a few mistakes come up again and again. The biggest one, by far, is forgetting about all the little "death by a thousand cuts" fees that quietly siphon away your revenue.

Be extra careful you aren't making these classic mistakes:

- Forgetting transaction fees: Every single sale has a processing fee attached, whether it's from Shopify Payments, Stripe, or PayPal. They add up fast.

- Ignoring the cost of returns: When a customer sends something back, it's not free for you. You have to account for the return shipping label, the time your team spends processing it, and any repacking costs.

- Botching COGS on bundles: Selling a "kit" or a bundle of three products? Your COGS isn't the price of one item—it's the combined COGS of every single product in that bundle.

Stop overpaying for the tools you need to grow. EcomEfficiency gives you access to 50+ premium e-commerce tools for SEO, ad-spy, and product research for one low monthly price. Cut your software costs by up to 99% and start making smarter decisions today. Explore the tools at EcomEfficiency.