How to Reduce Customer Acquisition Costs That Work

To get a handle on customer acquisition costs, you need to attack the problem from two angles: get smarter with your marketing budget and get more value out of every customer you win. It's not just about slashing your ad spend. It's about making every dollar you do spend work harder by cutting out what’s not working and doubling down on what is.

The goal is to scale without dubious shortcuts and without hurting your credibility.

Why Your Customer Acquisition Costs Keep Rising

If you feel like you're pouring more and more money into your marketing just to keep sales level, you're not imagining things. The hard truth is, winning new customers is more expensive now than it's ever been.

This isn't just a hunch; the data backs it up. Since 2020, customer acquisition costs (CAC) have shot up. Some studies point to a staggering 60% increase over just five years. That jump can range from 15% in slower-moving industries to a painful 60% in really competitive ones.

It’s a global trend hitting both B2B and B2C businesses. In the SaaS world, for example, the median cost to acquire a new customer rose by 14% in 2024 alone. That means companies are now spending $2.00 for every $1 of new annual recurring revenue. You can dig into more of these CAC trends and what they mean over at DevRev.ai.

The Forces Driving Up Your Spend

So, what’s actually causing this? It’s not one single thing but a combination of factors that have turned customer acquisition into a much tougher game. Once you understand what you're up against, you can start building a strategy to fight back.

The biggest culprit is the sheer level of competition on digital ad platforms. As more and more businesses have shifted online, places like Google Ads and Meta Ads have become digital battlefields. The classic auction system means more bidders for the same ad space, which naturally drives up your cost-per-click (CPC) and cost-per-mille (CPM). You're simply forced to pay more for the same eyeballs.

On top of that, your audience is scattered everywhere. Think about all the places a potential customer might be hanging out:

- Social Media: TikTok, Instagram, Facebook, LinkedIn, Pinterest

- Content Platforms: YouTube, podcasts, niche blogs

- Online Communities: Reddit, Discord, private forums

This fragmentation makes it incredibly difficult to figure out where your ideal customers are actually spending their time. It often leads to a lot of wasted money on channels that just don't deliver.

The old playbook of just outspending the competition is dead. The new game is about outsmarting them. That means focusing on efficiency, making decisions based on solid data, and building real relationships that keep customers coming back.

And to make things even more complicated, new privacy rules and the slow death of third-party cookies mean tracking user behavior and targeting ads is getting harder. We're all having to shift away from those hyper-specific targeting strategies and get back to basics with broader campaigns and a much stronger focus on collecting our own first-party data.

All these challenges mean you can't just keep doing what you've always done. You need a smarter, more deliberate approach to lower your acquisition costs without stalling your growth.

Master Your Marketing Channels for Better ROI

Throwing money at every marketing channel out there is like playing darts in the dark—you might hit the board, but you'll probably miss more often than not. It's a surefire way to drain your budget fast. A much sharper approach is to treat your marketing budget like a savvy investor handles their portfolio: constantly auditing, rebalancing, and doubling down on what works.

This all comes down to knowing your numbers. I'm not talking about vanity metrics like clicks and impressions. You need to dig deeper to see which channels are your true workhorses and which are just costing you money.

Finding Your Most Profitable Channels

To get a real sense of performance, you need to track a few crucial KPIs for every single channel, from your paid Google Ads campaigns to your organic social media efforts.

- Cost Per Lead (CPL): What's the real cost to get one potential customer to show interest?

- Conversion Rate: Of those leads, how many actually pull out their wallets and buy something?

- Customer Lifetime Value (CLV): How much is a customer from a specific channel really worth to you over the long haul?

Looking at these numbers together tells the full story. For instance, a channel might boast a super low CPL, which looks great on the surface. But if those leads never convert, you're just paying for window shoppers. The actual cost to acquire a real customer from that channel could be sky-high.

A Quick Look at Where to Start

Not all channels are created equal, and where you spend your first dollar can make a huge difference. Here’s a quick snapshot to help you think about where your brand fits best.

Marketing Channel Performance Snapshot

This table breaks down some of the most common digital marketing channels. Think of it as a starting point to help you prioritize where to focus your energy and budget based on typical performance and your business goals.

| Channel | Typical CAC | Best For | Key Metric to Watch |

|---|---|---|---|

| SEO/Content Marketing | Low (but long-term) | Building trust, attracting high-intent buyers, long-term growth. | Organic Traffic & Keyword Rankings |

| Paid Search (e.g., Google Ads) | Medium to High | Capturing immediate purchase intent; targeting specific searches. | Return on Ad Spend (ROAS) |

| Social Media Ads (e.g., Meta) | Low to Medium | Building brand awareness, retargeting, finding new audiences. | Cost Per Acquisition (CPA) |

| Email Marketing | Very Low | Nurturing leads, retaining customers, driving repeat purchases. | Open Rate & Conversion Rate |

| Influencer Marketing | Varies Wildly | Reaching niche audiences, building social proof, driving impulse buys. | Engagement Rate & Direct Sales |

Remember, these are just general guidelines. The real magic happens when you analyze your own data to see what works for your specific audience and products.

How to Reallocate Your Budget for a Bigger Impact

Once you have the data, it's time for a channel-by-channel audit. I find a simple spreadsheet works just as well as any fancy dashboard for this. Line up your platforms and look for the outliers—the ones that are knocking it out of the park and the ones that are clearly lagging.

You might find that your TikTok ads are bringing in a flood of cheap leads, but those people rarely turn into high-value customers. At the same time, you might see that your long-form blog content (SEO) brings in way fewer leads, but they convert at a much higher rate and have a CLV that's twice as high. That's the kind of "aha!" moment that can completely change your strategy.

This isn't just about slashing budgets. It’s about being smarter with your spend. By shifting money from your underperforming channels to your proven winners, you’re pouring fuel on a fire that’s already burning bright.

A Real-World Budget Shift

Let's walk through a common scenario. Imagine an e-commerce brand spending $5,000 a month on Facebook Ads and another $5,000 on Google Shopping. After looking at the numbers for a quarter, here’s what they find:

At first glance, Facebook looks like the winner with a lower $50 CAC compared to Google's $67. But hold on—the customers coming from Google Shopping are spending twice as much per order. This is where a strategic budget shift makes all the difference.

Instead of keeping that 50/50 split, they could make a smarter move:

- Pull back on Facebook Ads to $3,000 a month, focusing only on the absolute best-performing campaigns.

- Push the Google Shopping budget up to $7,000 a month to attract more of those high-spending customers.

This simple adjustment immediately funnels resources toward the channel delivering a much better return on ad spend (ROAS). It's a direct, data-backed decision that makes every dollar work harder. This disciplined cycle of auditing and reallocating is the key to systematically lowering your acquisition costs over time.

Use AI to Slash Your Acquisition Spending

Let's be clear: artificial intelligence isn't some futuristic idea reserved for mega-corporations. It’s a real, accessible tool that you can put to work right now to get more out of every dollar you spend on ads. Instead of manually guessing which campaigns are hitting the mark, AI handles the complex analysis, pointing you directly to high-value customers for less money.

One of the most powerful ways to do this is with predictive lead scoring. Think of it like a crystal ball for your leads. These tools dig into the data of your past customers—their browsing habits, demographics, purchase history—to figure out what your perfect buyer looks like. The AI then scores new leads as they come in, giving your team a clear signal on who is most likely to buy.

Suddenly, you’re no longer wasting your budget chasing leads that were never going to convert. Your team can pour its resources into nurturing the prospects with the highest chance of becoming customers, which is a massive win for efficiency.

The infographic below shows just how much acquisition costs can vary by channel. This is where AI optimization can really make a difference, especially in the more expensive channels.

As you can see, paid channels like PPC often come with a higher price tag. That makes them the perfect place to use AI to squeeze maximum value out of every ad dollar.

Put Bidding and Personalization on Autopilot

Another area where AI is a total game-changer is AI-driven ad bidding. You're likely already using this if you advertise on platforms like Google or Meta. Their internal algorithms are constantly working behind the scenes, adjusting your bids in real-time based on thousands of signals to get your ad in front of the right person at the best possible price.

The real magic of AI in marketing is achieving precision at a massive scale. It gets rid of the guesswork and lets you make smart, data-driven decisions that directly cut acquisition costs without stunting your growth.

But it’s not just about bidding. AI is also your best friend for creating hyper-personalized campaigns. For an online store, this can look like a few different things:

- Dynamic Creative Optimization: The AI can test countless combinations of your ad copy, images, and headlines to automatically find the winning formula that drives the most conversions.

- Personalized Product Recommendations: You can show returning visitors ads for products they've already looked at or things you know they’ll be interested in based on their past behavior.

- Automated Customer Segmentation: AI can instantly group your audience into tiny, specific segments, allowing you to craft highly relevant messages that really connect and convert.

Using these tactics means your budget is spent showing the most compelling ad to the most receptive audience. It's a straight line to a lower CAC. In fact, many e-commerce, fintech, and SaaS businesses have already seen their CAC fall by up to 50% compared to what they were getting with traditional methods. If you dig into the latest customer acquisition statistics, you'll see how AI's ability to fine-tune targeting and automate bidding is making these savings possible.

It's Cheaper to Keep a Customer Than to Find a New One

https://www.youtube.com/embed/Y6IBkNNkfJg

We all get caught up in the chase for new customers. But while you're optimizing ad campaigns and tweaking landing pages, you might be ignoring the most powerful way to slash your acquisition costs: taking care of the customers you already have.

Think of it like a leaky bucket. Every time you lose a customer, you have to spend money to pour a new one in, just to stay at the same level. Plugging those leaks by focusing on retention stops this expensive cycle in its tracks.

The numbers don't lie. It can be anywhere from 5 to 25 times more expensive to land a new customer than to keep an existing one. Plus, happy customers become your best marketing asset. They don't just buy again; they tell their friends. Data shows referred customers have a 16% higher customer lifetime value (CLV) and are far more likely to bring in more customers. It’s a growth loop that feeds itself. For a deeper dive into the data, check out these customer acquisition statistics.

Nail the Onboarding Experience

The moment someone buys from you isn't the end of their journey—it's the beginning. A confusing or underwhelming experience right after purchase is a fast track to churn. Your job is to make them feel brilliant for choosing you.

If you sell software, this means a slick, guided tour that helps them achieve their first small win immediately. For an e-commerce store, it’s that satisfying unboxing experience followed by a thoughtful email showing them how to get the most out of their new product.

A great onboarding experience validates the customer’s purchase. It's your first real chance to turn a one-time transaction into a long-term relationship with a fan who feels seen and appreciated.

Getting this right builds immediate confidence and lays the groundwork for loyalty, making every dollar you spent to acquire them a much smarter investment.

Create a Loyalty Program People Actually Want

Let's be honest: a simple "buy 10, get one free" program doesn't cut it anymore. To keep people coming back, your loyalty program needs to feel exclusive and offer real, tangible value. Go beyond just discounts.

Here are a few ideas that work:

- Early Access: Give your best customers first dibs on new product drops or major sales. The feeling of being an insider is a powerful motivator.

- Exclusive Content: Create members-only tutorials, behind-the-scenes content, or access to a private community.

- Tiered Rewards: Structure your program with levels (e.g., Bronze, Silver, Gold). As customers spend more, they unlock better perks, giving them a clear incentive to stick with you.

Making the switch from constantly chasing new leads to nurturing your existing customer base is fundamental to lowering CAC. By putting proven customer retention strategies into practice, you set your business up for more sustainable, long-term growth.

Keep the Conversation Going After the Sale

Don't let the relationship go cold after the credit card is charged. That post-purchase period is a golden opportunity to build a real connection and set the stage for the next sale.

Move beyond the generic "thanks for your order" email. Create an automated follow-up sequence that continues to provide value. A week after delivery, you could ask for feedback. A few days later, you could send a video on how to use their new item. Later, you might offer a personalized discount on a product that pairs perfectly with their first purchase.

This kind of consistent, helpful communication turns a transaction into a relationship. It boosts the lifetime value of every customer, which in turn drives down your blended customer acquisition cost over time.

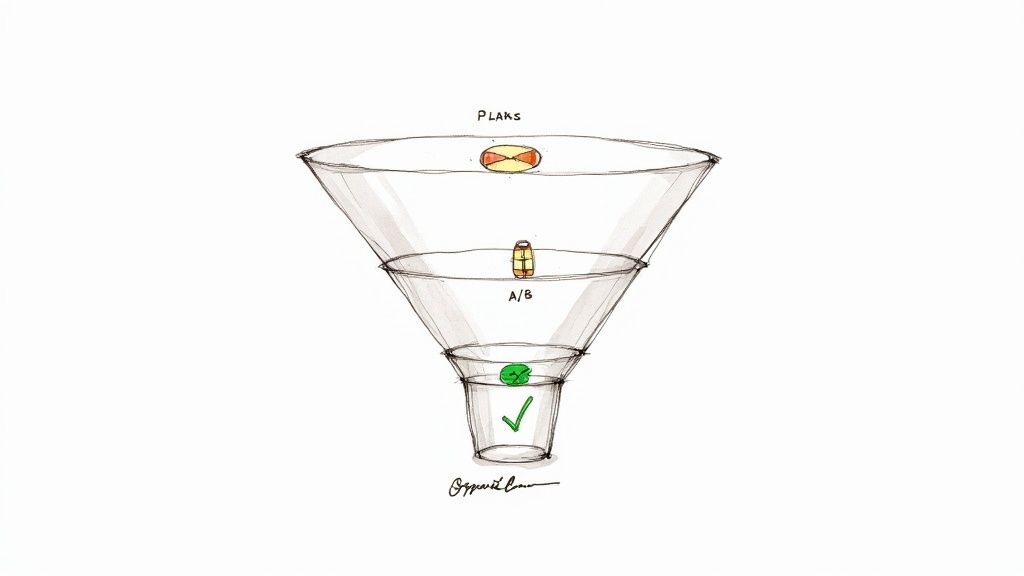

Optimize Your Funnel for Higher Conversions

Getting traffic to your website is only half the battle. If your sales funnel has leaks—and they all do—you're just throwing ad money away. Think about it: every visitor who gets frustrated by a confusing layout or a slow-loading page is a potential customer you paid to acquire, only to lose them moments later.

This is where Conversion Rate Optimization (CRO) becomes your secret weapon. It’s all about systematically finding and plugging those leaks to turn more of the visitors you already have into paying customers.

Start with Smart A/B Testing

Making changes based on a gut feeling is a surefire way to waste time and money. A/B testing, on the other hand, lets your audience tell you exactly what works. You simply show two different versions of a page to different groups of visitors and see which one gets more clicks, sign-ups, or sales.

You don't have to rebuild your whole site. Focus on high-impact elements first for some quick wins:

- Headlines: Pit a benefit-driven headline ("Get Flawless Skin in 30 Days") against a curiosity-piquing question ("Tired of Wasting Money on Skincare?").

- Calls-to-Action (CTAs): Does a straightforward "Buy Now" work better, or does a button with more urgency like "Claim Your 50% Off Now" drive more action?

- Images: Test a clean studio shot of your product against a lifestyle photo showing it in action.

Even tiny improvements from these tests can have a massive impact, effectively doubling the value of your ad spend without costing you a dime more in traffic.

Simplify the Path to Purchase

The checkout process is the final hurdle, and it's where so many sales die. In fact, nearly 70% of online shopping carts are abandoned. Why? It's usually something simple: a surprise shipping fee, a form that asks for too much information, or just one too many steps.

Your job is to make buying from you ridiculously easy.

Take a hard look at your checkout flow from a customer's perspective. Can you get rid of any form fields? Do you offer a guest checkout option? Are shipping costs and taxes shown upfront? Every bit of friction you remove makes it more likely that someone will complete their purchase.

The most effective way to reduce customer acquisition costs is to make it incredibly easy for people to give you their money. Every click you save a customer is a potential sale you've just saved.

Finally, don't overlook site speed. We live in an impatient world. If your landing pages take more than a couple of seconds to load, a huge chunk of the visitors you just paid for will bounce before your offer even appears. Optimizing your images and using a fast, reliable web host aren't just technical details—they're fundamental to keeping those hard-won visitors on your site.

Common Questions on Reducing CAC

Even with a solid plan, you're bound to have questions. Let's get into some of the most common ones that come up when you start getting serious about lowering your customer acquisition costs.

What Is a Good Customer Acquisition Cost?

This is the million-dollar question, but the answer isn't a single number. A "good" CAC is all about its relationship to your Customer Lifetime Value (LTV).

The classic benchmark for a healthy business is a 3:1 LTV to CAC ratio. Simply put, for every dollar you spend bringing a new customer in the door, you should be making at least three dollars back from them over time.

A subscription software company can afford a much higher CAC upfront because they have predictable recurring revenue. An e-commerce brand selling lower-priced items, on the other hand, needs that payback to happen much faster. Stop chasing a universal "good" number and focus on hitting a profitable ratio for your specific business model.

How Quickly Can I See My CAC Go Down?

How fast you'll see results really depends on which levers you're pulling. Some tweaks give you a quick win, while others are more of a long-term play.

Short-Term (Within Weeks): Optimizing your ad campaigns, A/B testing a new headline on your landing page, or removing a step from your checkout process can produce results almost immediately. These are the quick fixes that can offer a nice boost in a matter of weeks.

Long-Term (Months): Deeper strategies, like building a real SEO presence through content or launching a loyalty program, take time to gain traction. You might see the needle start to move in 3-6 months, but the real, game-changing impact often takes a year or more to fully materialize.

The best approach is to do both—mix quick optimizations with foundational, long-term strategies.

The fastest way to know if your changes are working is to calculate your CAC correctly. If you don't have a solid baseline, you're just flying blind. To get a clear picture of what you're actually spending, a tool like this Customer Acquisition Cost Calculator Guide is invaluable.

What Role Does Content Marketing Play in Lowering CAC?

Content marketing is your secret weapon for bringing down your blended CAC over the long haul. Think about it: with paid ads, the moment you stop paying, the traffic stops. But a single, high-value blog post can continue to attract organic traffic and generate leads for years.

This makes your whole acquisition engine more efficient. A great guide you publish today could still be bringing in qualified customers two years from now, with zero additional ad spend. The upfront effort pays dividends again and again.

On top of that, great content builds trust. It positions you as an expert. This creates a halo effect that actually makes all your other marketing—including your paid ads—convert better. Every marketing dollar you spend just works harder.

Ready to slash your software spending and access the top e-commerce tools in one place? EcomEfficiency bundles 50+ premium AI, SEO, and ad-spy tools to help you grow faster for less. Stop paying thousands in monthly fees and join over 1,000 members who are saving up to 99% on their tool stack. Get started today at https://ecomefficiency.com.