How to Find Winning Products for Your Online Store

Finding a winning product really boils down to a simple, repeatable formula. You need to uncover a real customer problem, find something that solves it in a unique way, and then—this is the critical part—confirm people will actually pay for it before you go all-in. Success in e-commerce isn't about guesswork or chasing the latest fad; it's a methodical process of smart research and validation.

The goal is to scale without dubious shortcuts and without hurting your credibility.

Why Most E-commerce Products Don't Make It

Before we jump into the hunt for your next bestseller, let's talk about a tough truth that trips up so many aspiring entrepreneurs. The e-commerce graveyard is full of abandoned stores and forgotten products. It’s not because the founders weren't passionate; it’s because they skipped the foundational work.

The number one reason most products fail is a massive disconnect from what the market actually wants. Too many new sellers fall in love with their idea for a product without ever stopping to ask if anyone really needs it. They'll see a cool gadget on TikTok or a trending item on Amazon and dive in headfirst, assuming the demand is a given. That approach is a fast track to failure.

The "Perfect" Product Is a Myth

Let's get one thing straight: the hunt for a single, "perfect" product is a trap. Your real goal should be to build a system for spotting opportunities time and time again. Winning products aren't found by luck; they're uncovered through a deliberate process. New sellers tend to make the same handful of mistakes:

- Jumping on Saturated Trends: By the time a product goes viral, you're already late to the party. Thousands of sellers are in a race to the bottom on price, and your profit margins will get crushed.

- Ignoring Market Feedback: They build an entire brand, order inventory, and launch ad campaigns without ever testing the waters. Then they're left wondering why nobody is clicking the "buy" button.

- Solving a Problem Nobody Has: The product might be clever or interesting, but if it doesn't solve a real, nagging pain point, it’s a tough sell. "Nice-to-have" items are infinitely harder to market than "must-have" solutions.

This isn't just a hunch; the numbers are brutal. Of the 30,000 new products launched globally each year, a staggering 95% of them fail. As detailed in research from MIT Professional Education on why new products miss the mark, this usually comes down to a complete lack of market alignment.

Shifting Your Mindset for Success

To get good at finding winning products, you have to change how you think. Stop thinking like a seller who just wants to move inventory, and start thinking like a problem-solver. A winning product is nothing more than a physical solution to a specific problem for a specific group of people.

The most successful e-commerce stores don't just sell products; they sell outcomes. A customer isn't buying a posture corrector; they're buying relief from back pain and the confidence that comes from standing taller.

This guide will walk you through a repeatable workflow designed to help you sidestep these common mistakes. We're going to build a foundation on real data and customer insight, not just wishful thinking. By understanding why so many products fail, you’re already putting yourself way ahead of the competition.

Uncovering Opportunities with Deep Market Research

Spotting a trending product is just the start. If you want to build a business that lasts, you have to go deeper than surface-level data. This is where you find your edge—by becoming a market detective.

Forget just looking at what's selling. The real question is why it's selling. You need to get to the heart of the problems, desires, and frustrations that actually drive someone to click "buy." This kind of solid market research is the bedrock of every successful product I've ever seen launched.

Skipping this step is a recipe for disaster. It's a harsh truth, but about 20% of new product launches miss the mark, often because of weak market research. As detailed in these product launch statistics from BrainKraft.com, the winners are almost always the ones who obsess over solving a real problem for a specific group of people.

Become a Digital Anthropologist

Your first job is to become a fly on the wall in the online communities where your potential customers hang out. These places are absolute goldmines of unfiltered opinions, raw feedback, and genuine pain points. You're not there to sell anything yet. You're there to listen.

Here's where I always start my digging:

- Reddit Subreddits: Find communities built around a hobby, profession, or lifestyle. I look for threads where people are asking for product recommendations, complaining about what they already own, or even sharing DIY solutions. That's where the opportunities are.

- Facebook Groups: Niche groups are fantastic for observing real conversations. Pay close attention to the exact words people use to describe their problems—that's powerful marketing copy you can use down the road.

- Industry Forums: For super-specific niches (think car detailing or specialty coffee), dedicated forums give you access to expert-level discussions that can reveal surprising gaps in the market.

As you're browsing, look for patterns. Are dozens of people griping about a product's terrible battery life? Are they all wishing for one specific feature? These repeated complaints are your roadmap.

Analyze Your Competitors' Weaknesses

Competition isn't something to fear; it's proof that a market exists. Your goal is to figure out what current sellers are doing well, and more importantly, where they're letting their customers down. This is how you carve out your own space.

One of the simplest, most effective things you can do is a deep dive into competitor product reviews. Forget the 5-star ratings—they don't teach you much. The real intelligence is buried in the 2- and 3-star reviews.

"I love the concept, but..." or "It works well, except for..." These are the golden phrases you're looking for. They literally hand you a blueprint for innovation, telling you exactly what to improve.

I recommend keeping a simple spreadsheet to track recurring complaints across different competitors. For example, if three different brands of a popular kitchen gadget have reviews mentioning a "flimsy handle" or that it's "impossible to clean," you've just found your angle for a better product.

Create Detailed Customer Avatars

You can't sell to a faceless crowd. To be effective, you need to know exactly who you're talking to. This means going way beyond basic demographics like age and location. A customer avatar, or persona, is a detailed profile of your ideal buyer that feels like a real person.

Give them a name. A job. A backstory. What frustrates them every day? What are their biggest goals?

For example, don't just target "women aged 25-40." Create "Stacy," a 32-year-old marketing manager who loves staying healthy but is too busy for complicated meal prep. Suddenly, every decision—from product features to ad copy—becomes clearer. You're no longer searching for a product; you're searching for Stacy's perfect solution.

Gathering these deep customer insights is crucial. Different platforms offer unique windows into your audience's world.

Effective Market Research Channels

| Research Channel | Primary Use Case | Type of Insight |

|---|---|---|

| Reddit/Forums | Observing unfiltered conversations and problem-solving | Raw pain points, niche vocabulary, and feature requests. |

| Competitor Reviews | Identifying product weaknesses and market gaps | Specific complaints, desired improvements, and unmet needs. |

| Social Media Groups | Understanding community dynamics and language | Common questions, shared frustrations, and lifestyle context. |

| Surveys/Polls | Validating assumptions with direct feedback | Quantitative data on preferences, buying habits, and priorities. |

By combining insights from these different channels, you build a multi-dimensional view of your target customer, ensuring your product development is guided by real-world needs, not just guesswork.

Use Free Tools to Validate Demand

The qualitative research from communities and reviews gives you the "why," but you still need some numbers to back it up. Free tools are perfect for this initial gut check on market demand.

- Google Trends: This should always be your first stop. Plug in your product idea and see what the search interest looks like over the past few years. Is it a steady evergreen product, a rising star, or a dying fad? You can also compare a few keywords to see which term people are actually searching for.

- Exploding Topics: Tools like this (including some features within the EcomEfficiency suite) are great for spotting trends right as they start to take off. This gives you a shot at getting in before the market is completely flooded with competitors.

When you blend this people-focused detective work with hard data, you get a 360-degree view of your market. You stop chasing trends and start creating solutions, setting yourself up for a product that doesn't just launch, but genuinely connects with customers.

How to Spot Product Trends Before They Peak

Once you have a solid feel for your market, it’s time to zoom in and start hunting for specific product opportunities. Finding a winner is all about timing—you want to catch a trend on its way up, not after it’s already peaked and the market is swamped with sellers. This isn’t about luck; it’s about building a repeatable process to see these rising stars before your competitors do.

The trick is to combine the hard data you get from powerful tools with the softer, qualitative insights that come from really paying attention to online culture. Relying on just one or the other leaves you with a blind spot. Data tells you what’s selling, but scrolling through social media tells you why people are suddenly obsessed with it.

Using Tools to Find Upward Momentum

Product research software, like the tools in our EcomEfficiency suite, is incredible for spotting products that already have some sales velocity. But the real skill is learning to see past what’s just popular today and identify what has the potential to explode tomorrow.

Instead of just sorting by "best-sellers," get creative with the filters. You’re looking for products that were listed recently but have already racked up a surprising number of sales or saves. That’s a tell-tale sign that a product is new but catching on fast—exactly the kind of early trend you want to jump on.

Here’s a practical workflow I use to find these hidden gems:

- Filter by Launch Date: Set your search to only show products added in the last 30 to 60 days. This immediately clears out the old, established items.

- Sort by Sales Velocity: Now, arrange this filtered list by sales volume or the number of other stores that have imported it.

- Validate with a Growth Curve: Once you have a promising product, pop its name into a tool like Google Trends or Exploding Topics. A gentle upward slope is nice, but a "hockey stick" curve showing a sharp, recent spike in interest? That’s the signal you’re really looking for.

This method helps you find products that are still very early in their lifecycle, giving you a massive head start before the market gets saturated.

Decoding Viral Content on Social Platforms

Tools give you the numbers, but social media gives you the story. Trends don’t just appear out of nowhere; they start as conversations, memes, and videos on platforms like TikTok and Pinterest. Learning to read the digital room is a critical skill for organic product discovery.

On TikTok, hashtags like #TikTokMadeMeBuyIt or #AmazonFinds are good places to start, but the gold is often buried in niche communities. Keep an eye out for user-generated videos—the ones that aren't slick or professionally produced—that are getting tons of comments and shares. This is raw, authentic proof that a product is genuinely solving a problem or making people happy.

Don't just watch the viral videos; read the comments. This is where you find unfiltered customer feedback. You'll see questions, ideas, and complaints. Phrases like "OMG where did you get that?!" or "I just wish it came in blue" are pure gold for product validation and development.

Pinterest is another beast entirely, and it's often overlooked. It's especially powerful for visual niches like home decor, fashion, and crafts. The platform is naturally forward-looking because people use it to plan for the future. Use the Pinterest Trends tool to see what people are searching for before it hits the mainstream. A spike in searches for "dark academia office" in August could signal a huge home office trend for the fall and winter seasons.

Dissecting Amazon's Movers and Shakers

Amazon's "Movers & Shakers" list is a live feed of products with the biggest sales rank jumps in the last 24 hours. A lot of sellers just look at this list to copy the top product. That's a mistake. The smarter play is to analyze the patterns behind the products.

Don’t just ask, "What is this product?" Ask, "What problem does this product solve, and why is everyone suddenly buying it right now?"

For instance, you might see a specific brand of portable neck fan jump 500% in sales rank. The opportunity isn't just that one fan. The real insight is the sudden, massive demand for personal cooling solutions. That opens up a whole category of related ideas: cooling towels, handheld misters, or premium insulated water bottles.

By looking for the broader trend behind a specific hot product, you can innovate instead of just imitating. This strategic mindset helps you find a unique angle in a trending market, which is far more profitable and sustainable than just trying to be the cheapest seller of the exact same thing. When you blend tool-based data, social listening, and smart marketplace analysis, you create a powerful system for consistently finding products with real momentum.

Validating Your Product Idea Without Wasting Money

So, you’ve done the hard research and found what looks like a real winner. The temptation to jump straight into sourcing from suppliers is huge right now, but pump the brakes. A great idea on paper is just that—an idea. You need to prove the market actually wants it before you risk a single dollar on inventory.

Think of this stage as your insurance policy against a garage full of products nobody wants to buy.

The mission is simple: get real-world proof that people will open their wallets for your product, all without committing to a massive upfront investment. We're moving from research and theory into a practical, low-cost experiment. This is where your assumptions meet reality, and it's the single most important part of finding a true winning product.

The Power of a Simple Landing Page

Forget building a full-blown Shopify store for now. Your first and most powerful validation tool can be a single, well-designed landing page. Its only job is to present your product concept clearly and ask for one simple thing: an email address.

This is what's known in the industry as a "smoke test." You're gauging genuine interest. If someone is willing to give you their personal email to be notified when your product launches, that’s a powerful signal that you're onto something big.

A "like" on social media is passive and cheap. An email sign-up, on the other hand, is an active step. It shows a much higher level of intent and commitment.

Running Small-Scale Ad Campaigns

Once your landing page is live, it’s time to send some highly targeted traffic its way. This is where all that audience research you did earlier pays off. Set up a small, focused ad campaign on a platform like Facebook or TikTok with a budget as small as $50-$100.

Remember, you aren't trying to make sales yet. You're buying data. The goal of this tiny ad spend is to test your messaging, your visuals, and maybe even a proposed price point.

Here's what to watch for:

- Click-Through Rate (CTR): Are people actually clicking your ad? A high CTR means your creative and headline are grabbing the attention of the audience you targeted.

- Cost Per Click (CPC): How much are you paying for each visitor? This gives you an early, ballpark figure for what your customer acquisition costs might look like later on.

- Conversion Rate: This is the big one. What percentage of visitors who land on your page actually leave their email? A strong conversion rate (aim for 2-5% or higher) is solid proof that the product idea itself is a winner.

A low CTR but a high conversion rate could mean your ad creative is weak, but your product idea is incredibly strong. A high CTR but a low conversion rate suggests the opposite: your ad is compelling, but the product isn't hitting the mark once people learn more. This kind of data is priceless.

This whole process—from research to validation—is about combining different signals to build a complete picture. The decision tree below shows how you can blend data tools, social listening, and practical tests to find a trend worth pursuing.

As you can see, the path to a winning product isn't linear. It's about pulling insights from multiple sources before you ever commit to a big spend.

Free Validation in Niche Communities

Don't have a budget for ads? No sweat. You can get incredibly valuable feedback for free just by tapping into those online communities you identified during your research. The trick here is to ask for feedback, not to sell.

Head into a relevant Reddit subreddit or Facebook group and be completely transparent. Try posting something like, "Hey everyone, I'm working on a new [product] to solve [problem]. Here’s a quick mockup. Is this something you'd find useful? What features am I missing?"

The insights you’ll get from true enthusiasts and experts are often more detailed and actionable than paid ad data. You can refine features, tweak your messaging, and even build a small tribe of early supporters before you've spent a penny on development.

This community-first approach can generate massive buzz if done right. Look at Dyson's launch of its Airstrait hair straightener. By seeding the product with key beauty influencers, a single social media post generated an estimated $65,000 in media impact value (MIV). The product quickly sold out, proving its "winner" status almost overnight. You can read more about how top brands nailed their product launches and see just how powerful this strategy is.

Finding Reliable Suppliers and Ensuring Profitability

You've done the hard work of validating your product idea and have real data showing people want to buy it. That's a huge win, but let's be clear: this is only half the journey. A brilliant product concept can quickly become a logistical nightmare if your supply chain is shaky or your profit margins are based on wishful thinking.

This is where the real business begins—the crucial backend work that separates the pros from the amateurs. Nailing this part means finding a manufacturing partner you can trust and truly understanding your numbers to build a business that lasts.

How to Find and Vet Quality Suppliers

Your search for a supplier will almost certainly start on a massive sourcing platform like Alibaba. The sheer number of options can feel overwhelming at first, but with a methodical approach, you can cut through the noise and spot the real gems.

My first piece of advice? Don't just sort by lowest price. The cheapest supplier is rarely the best one. You're looking for a partner, not just a factory, which means finding a solid balance of cost, quality, and reliability.

A few key metrics can help you build a strong shortlist:

- Years in Business: Stick with suppliers who have been operating for at least 3-5 years. This is a good indicator of their stability and experience.

- Verified Supplier Status: Look for badges like "Gold Supplier" or "Verified Supplier." These mean the company has passed a third-party inspection, adding a layer of credibility.

- Response Rate: A high response rate—ideally 85% or better—shows they are active on the platform and attentive to inquiries.

Once you’ve narrowed it down to 5-10 potential suppliers, it’s time to start a conversation. Think of this as an interview. You’re not just placing an order; you're starting a critical business relationship.

A great supplier is more than just a vendor; they are a partner in your success. Clear communication and a willingness to answer detailed questions are non-negotiable. If they are evasive or difficult to deal with now, it will only get worse once you've placed a large order.

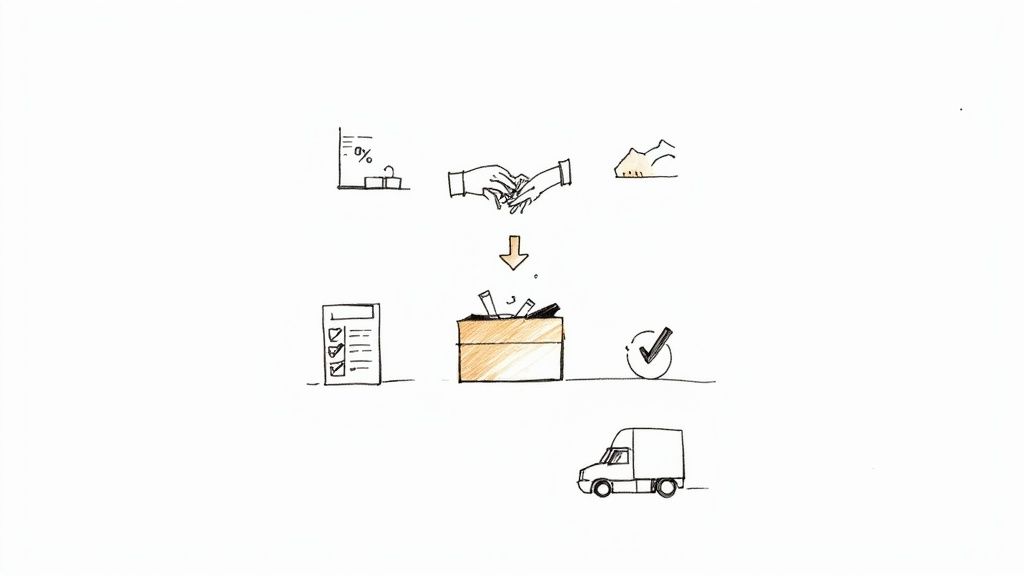

Ordering and Evaluating Samples

I’ll say it again for the people in the back: never, ever place a bulk order without getting a sample first. This is an absolute, non-negotiable rule in e-commerce. Photos and videos can be incredibly deceiving, and the only way to truly assess quality is to hold the product in your hands.

When that sample arrives, put on your most critical customer hat.

- Materials and Build Quality: Does it feel cheap, or is it sturdy? Are the seams straight? Is the finish consistent?

- Functionality: Does it work exactly as advertised? Test every single feature, button, and moving part.

- Packaging: How did it arrive? Does the packaging feel robust enough to survive international shipping and still look good when it reaches your customer?

If the sample isn’t quite right, don't panic. Provide clear, constructive, and specific feedback to the supplier. A good partner will be willing to make adjustments and send a revised sample. This back-and-forth is a normal and healthy part of the product development process.

Calculating Your True Profit Margin

Finding a winning product means finding one that actually makes you money. A classic rookie mistake is simply subtracting the product cost from the selling price and calling the rest profit. That’s a fast track to going out of business.

To build a sustainable brand, you need to understand two key numbers: your landed cost and your net profit margin.

The landed cost is the true cost of getting a single unit from the factory floor to your warehouse shelf, ready to sell. This includes:

- Cost of Goods: The per-unit price you pay the supplier.

- Shipping & Freight: The cost to ship the entire bulk order.

- Taxes & Duties: Import tariffs and taxes required to get your goods into the country.

Once you have that landed cost, you can figure out your actual profit per sale by subtracting all the other costs involved in that transaction.

This quick checklist summarizes the key factors to weigh before you go all-in on a product.

Product Viability Checklist

| Evaluation Criteria | What to Look For | Red Flags |

|---|---|---|

| Supplier Reliability | 3+ years in business, verified status, high response rate, good communication. | Vague answers, slow response times, refusal to send samples. |

| Sample Quality | Matches description, feels durable, works perfectly, has protective packaging. | Flimsy materials, functional defects, poor finishing. |

| Landed Cost | A clear breakdown of unit cost, shipping, and duties from your supplier/freight forwarder. | Hidden fees, supplier is unclear about shipping or import costs. |

| Net Profit Margin | A projected margin of at least 15-20% after all costs are factored in. | Thin margins (<10%) that leave no room for error or marketing spend. |

| Market Scalability | A product with potential for variations, accessories, or a related product line. | A one-off trend item with a very short shelf life. |

Ultimately, aiming for a net profit margin of at least 15-20% is a healthy target for most e-commerce businesses. This gives you the breathing room to handle returns, reinvest in marketing, and actually grow your business without feeling constantly squeezed.

Answering Your Burning Questions About Product Research

Even with the best roadmap, you're going to hit a few forks in the road. That's just part of the process. When you're just starting out, the world of product research is full of questions. Let's tackle some of the most common ones I hear from new sellers.

How Long Does It Really Take to Find a Winner?

I wish I could give you a simple number, but it just doesn't work that way. Finding a solid product might take a few weeks of intense focus, or it could be a couple of months of trying things out and learning as you go.

The most important thing to remember is that this isn't a race. Being thorough beats being fast every single time. If you rush through your research and skip the validation steps, you're almost guaranteed to pick a product that flops. Taking your time now to really understand a market will save you a world of pain and thousands of dollars down the line.

Should I Chase a Hot Trend or Stick with Something Evergreen?

This is the classic product-picking dilemma. Honestly, a smart store often has a little of both.

- Trendy Products: These are exciting and can bring a rush of sales. Think of those gadgets that blow up on TikTok. The downside? They can flame out just as fast, leaving you with a garage full of inventory nobody wants.

- Evergreen Products: This is your bread and butter. Things like quality kitchen tools or basic pet supplies have steady demand all year long. They provide stability.

My advice for new sellers? Find the middle ground. Look for an evergreen product category and add a fresh, trendy angle to it. This gives you a stable market foundation with a unique hook to draw people in. For instance, instead of a plain yoga mat (evergreen), you could source one made from sustainable cork with a cool, laser-etched design (trendy).

What’s a Realistic Profit Margin?

You absolutely have to know your numbers. For your gross profit margin—that’s your revenue minus the cost of the product and shipping—you should be aiming for 30-50% at a minimum. This buffer is crucial for covering everything else it takes to run your business.

But that's not your take-home pay. Once you subtract marketing costs, software fees, and payment processing, a healthy net profit margin usually lands somewhere in the 10-20% range. Always map out every single cost to make sure your pricing makes sense and actually lets you grow.

Is It a Bad Sign if There's a Lot of Competition?

Not at all. Actually, I get more nervous when I see zero competition. A complete lack of competitors is usually a giant red flag that nobody actually wants to buy what you're thinking of selling.

A market with healthy competition is proof that people are already spending money to solve the problem you're targeting. Your goal isn't to find an empty field. It's to walk into a crowded one, study the existing players, pinpoint their weaknesses by reading their bad reviews, and then launch something that's better, different, or serves a specific niche they're ignoring.

Ready to stop guessing and start using data to find your next bestseller? EcomEfficiency bundles over 50 premium e-commerce tools for product research, ad spying, and SEO into one affordable subscription. Cut your software costs by 99% and start finding winning products today at https://ecomefficiency.com.